What Is Volatility Risk

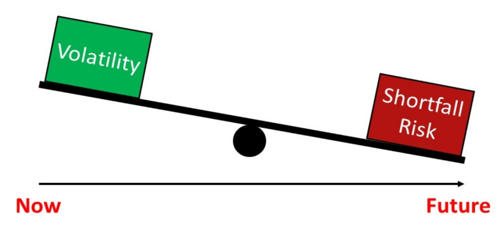

What Is Volatility Risk. Risk is different than volatility in that risk refers specifically to loss. However, volatility also increases risk.

And when it comes to risk mitigation, volatility is an important issue to consider. The vix offers a window into the state of volatility in the markets, which can help investors gauge the level of fear, risk, or. When it comes down to it, volatility is simply a measure of how risky a specific investment has become.

Volatility Risks Are Understood To Be The Amount Of Threat To A Given Investment, Based On Conditions Currently Taking Place In The Market.

The volatility risk premium (vrp) represents the reward for bearing an asset’s risk (e.g., equity downside risk). It is employed in the pricing of assets to assess changes in returns. The more the returns deviate from the expected return, the greater the risk.

We Show That Market Volatility Of Volatility Is A Significant Risk Factor That Affects Index And Volatility Index Option Returns, Beyond Volatility Itself.

The extent of price/rate changes around the mean in the past) and expected volatility is one of the major inputs in the price of an option. Volatility risk is the chance of a shift in the volatility of a risk factor that leads to losses. There are various ways to calculate volatility that are generally based on the historical prices of an asset or security.

Thus, The Rate/Price Of A Call Bond Will Change As Volatility And Expected.

However, volatility also increases risk. Risk refers to the possibility of loss, which is outcome focused. In some cases, the volatility of an asset or investment suddenly.

The Insurance Risk Premium In Options Reflects Investors’ Risk Aversion And Their Tendency To Overestimate The Probability Of Significant Losses.

For instance, the potential for particularly sharp retracements dissuades some traders from taking part in an extremely volatile market because the risk for losses is high. Risk neutral value under the q measure, and will rarely equal the real world value under the p measure. Risk is only a prediction of loss — and, by extension, irreversible loss — whereas volatility is a prediction of future price movement that includes both losses and gains.

It Shows The Range To Which The Price Of A Security May Increase Or Decrease.

It is a rate at which the price of a security increases or decreases for a given set of returns. This would include some indication that the value of an underlying security is about to enter into a period of fluctuation that will seriously impact performance of the investment. This is the risk to the value of an investment, usually an options portfolio, due to unpredictable changes in the volatility of the underlying asset.

Post a Comment for "What Is Volatility Risk"